The success stories of Silicon Valley startups and their growth made a big change in business paradigm worldwide. Tech savvies tend to start their own company and investors are more exit-oriented than before, giving up the dividend approach of traditional businesses. Mentors and startup consultants also lead them to negotiate on valuation. In this case, the potential investor seeks for less valuation, while the startup and previous investors fight for higher valuation of the company. Unfortunately, the scholars in entrepreneurship and finance could not come up with a practical valuation method so far; thus, the market and negotiations process decide for valuation of the company.

The Overvaluation Trap

When dealing with new fund raising, both the previous investors and startups want to close the deal at the highest possible price and sometimes they manage to overvalue their company during fund raising. At the very first glance, it seems that they made a really good job by closing the deal at the highest valuation possible, however, they might have fallen into the overvaluation trap they made themselves.

Overvaluation rarely happens, but yes! It does happen in several occasions. There are cases in which startups can create a monopoly or have an engendering leverage. When the momentum is on their side, the focus on making the company’s valuation high as possible and sometimes they succeed in doing it. In some other cases, a venture capitalist that already dominated the market is backing the startup; hence, joining that company in the upcoming fundraising rounds at any price seems logical to the others.

What Happens Next

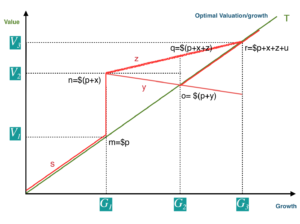

I have illustrated the overvaluation trap in the following graph. The two axis of the graph represent the value (vertical axis) and the growth (horizontal axis) and we have the following assumptions:

- Line T is the optimum line where value of the company is justified by the growth it made.

- Growth is the main factor of the company’s value and determines the market price.

- Line S (red) represents the overvalued company’s paths

As seen in the graph, line T is the optimal area in which price of the company is justified by the growth it made. Growth of the company is determined on several factors such as number of customers, active users, order, revenue, internal team, scope of operations, etc. depending on the business model of the firm. Company A and company B are both raising funds for their series A financing at the growth stage G1 and prices of p (point m) and p+x (point n) respectively. Company A’s price is on the optimal level in which there is a symmetry between value and growth. Company B, however, sets the price on p+x which is beyond the optimal level and its growth cannot justify the valuation.

As seen in the graph, line T is the optimal area in which price of the company is justified by the growth it made. Growth of the company is determined on several factors such as number of customers, active users, order, revenue, internal team, scope of operations, etc. depending on the business model of the firm. Company A and company B are both raising funds for their series A financing at the growth stage G1 and prices of p (point m) and p+x (point n) respectively. Company A’s price is on the optimal level in which there is a symmetry between value and growth. Company B, however, sets the price on p+x which is beyond the optimal level and its growth cannot justify the valuation.

Both companies grow and enter stage G2 in which company A – which is on the optimal line – sets the rational price of p+y for series B financing, where y<x. At G2 firm B should set a value higher than p+x of its previous round, but is it possible?

Let’s take the following scenarios for firm B at this point:

Best case scenario: The company B leapfrogs G2 and directly goes to G3 to reach the optimal price of r=p+x+z+u. This requires extraordinary growth, optimized cash-burn, and outstanding operations from the team. In this case the company should be dominating the market and have a sustainable revenue in order to be able to reach that point, which is only possible to be done via innovative business ideas or sort of a core technology that is not easy to follow by competitors.

Normal Case scenario: Company B’s cash-burn requires another fund raising at G2. Since the growth does not match price at point G2, the company B faces a “down round” at point o and sets price for p+y at highest, which is now in the optimal level of valuation and equal to company A. This is where things get interesting in real world of business; two companies that are similar to each other approach an investor and now one showing increase in value, while the other compromised on the valuation by accepting a down-round. Down-round valuation is the last thing that entrepreneurs should do in order to survive and depending on the terms with the previous investor, they also lose their substantial amount of share in the company.

If the company B faces a down-round and can make it to G3, what will be the value at G3? Another down-round or up-round? This depends on much more factors.

The Bottom Line

Overvaluation has an ostensible beneficial factor for entrepreneurs and they try their best in order to increase the value of their equity, but this can get really tricky. There are lots of tricks by some VCs that are more brokers than VC firms. They buy the company’s majority at seed or post seed stage make some intensive show-off and then at series A accept a full delusion and cash-out. Some others might use the overvaluation trick in order to be able to buy the next round’s equity by paying almost nothing (with the help of anti-dilution clause).

Overvaluation has some psychological consequences as well. The founding team sees the task of leading the company forward easier when you value the company more than what it is, as they really did not earn it. Cash-burn goes up, unnecessary employments goes up, productivity goes down, and success theatre hits the floor. Always make sure to have a sustainable momentum on your side before going for higher valuation. Consult more advisors than one and make sure you make the decision based on sufficient information from market and try to predict the future wisely.

MKsOrb.Com

[…]Sites of interest we’ve a link to[…]

thesis or dissertation https://professionaldissertationwriting.org/

dissertation uk help https://professionaldissertationwriting.com/

dissertation editing services https://helpwithdissertationwritinglondon.com/

proposal and dissertation help geography https://dissertationwritingcenter.com/

uk dissertation writing service https://dissertationhelpexpert.com/

thesis dissertation https://accountingdissertationhelp.com/

dissertation proposal example https://examplesofdissertation.com/

dissertation abstract example https://writing-a-dissertation.net/

online dissertation writing https://bestdissertationwritingservice.net/

help dissertation dissertation help https://businessdissertationhelp.com/

dissertation help india https://customdissertationwritinghelp.com/

help tutor https://writingadissertationproposal.com/

dissertation methodology https://dissertationhelpspecialist.com/

dissertation writing software https://dissertationhelperhub.com/

best online usa casino https://download-casino-slots.com/

caesars casino online https://firstonlinecasino.org/

pa online casino no deposit bonus https://onlinecasinofortunes.com/

golden casino online https://newlasvegascasinos.com/

online baccarat casino https://trust-online-casino.com/

casino online canada https://onlinecasinosdirectory.org/

real online casino usa https://9lineslotscasino.com/

resorts online casino nj https://free-online-casinos.net/

online casino no deposit bonus 2021 https://internet-casinos-online.net/

zone online casino https://cybertimeonlinecasino.com/

best online casino promotions https://1freeslotscasino.com/

highest payout online casino https://vrgamescasino.com/

san manuel online casino promo codes https://casino-online-roulette.com/

royaloander online casino https://casino-online-jackpot.com/

popular online casino https://onlineplayerscasino.com/

borgata online casino new jersey https://ownonlinecasino.com/

usa casino online https://all-online-casino-games.com/

usa casino online https://casino8online.com/

what is vpn https://freevpnconnection.com/

best vpn for chrome free https://shiva-vpn.com/

best free pc vpn https://ippowervpn.net/

free vpn firestick https://imfreevpn.net/

why buy a vpn https://superfreevpn.net/

best vpn for linux https://free-vpn-proxy.com/

vpn free reddit https://rsvpnorthvalley.com/

gay mature men dating site https://gay-singles-dating.com/

gay men vs women dating as a bi man https://gayedating.com/

gay dating in clarksville https://datinggayservices.com/

online single sites https://freephotodating.com/

american dating https://onlinedatingbabes.com/

world best dating sites https://adult-singles-online-dating.com/

dating seiten https://adult-classifieds-online-dating.com/

sex dating https://online-internet-dating.net/

dateing websites https://speedatingwebsites.com/

totally free dating site https://datingpersonalsonline.com/

absolutely free online dating sites https://wowdatingsites.com/

text hot naked singles https://freeadultdatingpasses.com/

dating services for seniors https://virtual-online-dating-service.com/

online dating website https://zonlinedating.com/

free online chat and dating sites https://onlinedatingservicesecrets.com/

online casino ny https://onlinecasinos4me.com/

echeck online casino https://online2casino.com/

what is the best online casino https://casinosonlinex.com/

nh gay chat https://newgaychat.com/

gay universe men chat https://gaychatcams.net/

aol chat room gay https://gaychatspots.com/

gay perv chat https://gay-live-chat.net/

live chat video gay https://chatcongays.com/

good gay video chat site https://gayphillychat.com/

rastaboy gay chat https://gaychatnorules.com/

gay page chat roulette https://gaymusclechatrooms.com/

gay chat cam https://free-gay-sex-chat.com/

chat gay granada https://gayinteracialchat.com/

gay danish english chat rooms https://gaymanchatrooms.com/

help writing paper https://term-paper-help.org/

best paper writing service reviews https://sociologypapershelp.com/

pay someone to write paper https://uktermpaperwriters.com/

help with writing a paper https://paperwritinghq.com/

paper writer services https://writepapersformoney.com/

write my papers https://write-my-paper-for-me.org/

someone to write my paper for me https://doyourpapersonline.com/

help in writing paper https://top100custompapernapkins.com/

custom thesis papers https://researchpaperswriting.org/

college papers writing service https://cheapcustompaper.org/

write my college paper https://writingpaperservice.net/

paper writers https://buyessaypaperz.com/

help writing a college paper https://mypaperwritinghelp.com/

will you write my paper for me https://writemypaperquick.com/

college paper ghost writer https://essaybuypaper.com/

writing paper services https://papercranewritingservices.com/

custom papers writing https://premiumpapershelp.com/

professional paper writing services https://ypaywallpapers.com/

where to buy papers https://studentpaperhelp.com/

3afterthought

coursework writing uk https://brainycoursework.com/

creative writing coursework https://courseworkninja.com/

creative writing coursework ideas https://writingacoursework.com/

buy coursework online https://mycourseworkhelp.net/

online coursework https://courseworkinfotest.com/

differential equations coursework https://coursework-expert.com/

coursework uk https://teachingcoursework.com/

do my coursework https://buycoursework.org/

do my coursework https://courseworkdomau.com/

free local dating sites https://freewebdating.net/

free dating sight https://jewish-dating-online.net/

st аugstine fl book matches online dateing https://jewish-dating-online.net/

dating single https://free-dating-sites-free-personals.com/

xxxlesbian dominance https://sexanddatingonline.com/

online marriage sites in usa https://onlinedatingsurvey.com/

free meeting online https://onlinedatingsuccessguide.com/

gay mature dating https://onlinedatinghunks.com/

online free dating site https://datingwebsiteshopper.com/

ourtime inloggen https://allaboutdatingsites.com/

best online dating websites https://freedatinglive.com/

singles and personals https://freewebdating.net/