The success stories of Silicon Valley startups and their growth made a big change in business paradigm worldwide. Tech savvies tend to start their own company and investors are more exit-oriented than before, giving up the dividend approach of traditional businesses. Mentors and startup consultants also lead them to negotiate on valuation. In this case, the potential investor seeks for less valuation, while the startup and previous investors fight for higher valuation of the company. Unfortunately, the scholars in entrepreneurship…

Venture Capital

Entrepreneur’s character is an axiomatic factor that fosters innovation and entrepreneurial activities. Entrepreneurship scholars have long been conducting research on entrepreneur’s character, contemplating it both as a major factor for entrepreneur’s success and a salient stimulus to entrepreneurial activities. Nonetheless, there has been less research on other players of entrepreneurship ecosystem such as venture capitalist.

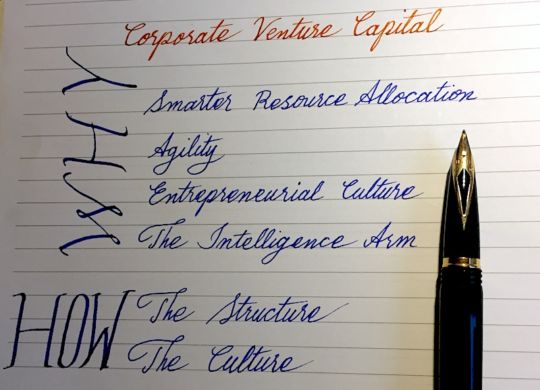

Startup events are ubiquitous nowadays and many companies and individuals are inclined to entrepreneurial practices. As a result, large enterprises have outrageously commenced to play a role in the entrepreneurial ecosystem by starting their investment arm or Corporate Venture Capital (CVCs) firms. I have recently been consulting two of these large companies to start their own CVCs and comparing these CVCs to the regular venture capitalists I have worked with, I maintain that these two types of venture investments are not…

The trend in entrepreneurship and startup activities has been shifting in the last decades. Concepts such as lean startup, customer development, and business model canvas, were introduced to the world of entrepreneurship and shorter pitches replaced long business plans. The one-minute pitch has been increasingly used among investors and in business competition events, however, many technopreneurs have still problem presenting their business idea in such a short time. They believe that the innovation and the complexity of the business idea…

Getting into a deal with a venture capital firm is the integral part of fund raising for most entrepreneurial firms. Many companies and entrepreneurs each day contact the venture capitalists in order to get a financial support for their firm’s growth. As a result, dozens of inquiries are heading to VC firms, from which some should be precisely handpicked.

In M&A negotiations, having vast home range and multiple nest sites is a complement to panoramic view, prey focus, and opportunity orientation. In this post I deal with this last important concept of the golden eagle strategy regarding M&A negotiations.

I have mentioned the role of panoramic view and prey focus together in the previous post and at this moment I deal with opportunity orientation regarding M&A negotiations.

The recent global economic crisis lead to a controversial trend against the one-percenters and the fact that their properties constitute the majority of the world’s wealth. The popularity of this idea was not only limited to the occupied Wall Street campaigns, but it also grew so fast that even Barack Obama used this trend as one of his main policies in the late 2012 by ending the tax cut of wealthy Americans in order to get better support from the…